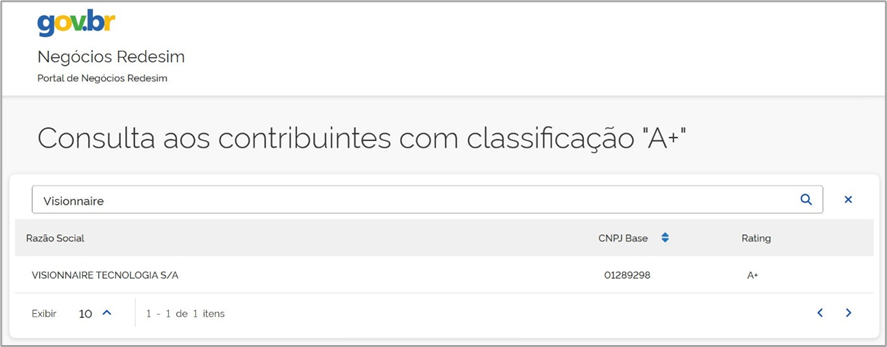

Classification attests to Visionnaire's tax best practices before the Federal Revenue

We are pleased to announce that Visionnaire has

been classified as an A+ Taxpayer in the Receita Sintonia Program, a tax compliance initiative aimed at encouraging companies

to adopt best practices and maintain regularity in fulfilling their tax obligations, granting benefits and differentiated

treatment to those that achieve high scores according to the compliance criteria established by the Brazilian Federal Revenue.

The A+ rating is the highest in the program and

places Visionnaire in the “Top 0.5%” among more than 21 million evaluated companies and over 60 million registered

companies.

The evaluation criteria for company classification

are:

· Registration:

Taxpayer registration regularity, registration status;

· Statements and records: Timely fulfillment of accessory obligations, frequency (delivery) and punctuality (deadline);

· Payment: Accuracy

of information provided in statements and records, solvency (indebtedness), payment compliance, installment compliance, and

punctuality;

· Consistency:

Regularity in collecting due taxes, consistency of DCTF (Federal Tax Credit and Debt Declaration), compliance, stability of

amendments, and declared revenue.

According to the Brazilian Federal Revenue, in order

for a company to obtain an A+ rating, it must achieve a score equal to or greater than 0.995, that is, 99.5%. This represents

a significant administrative, financial, and tax achievement, as well as an important asset for AE Company, Visionnaire’s

partner in accounting services.

Learn more about Receita Sintonia at this link.