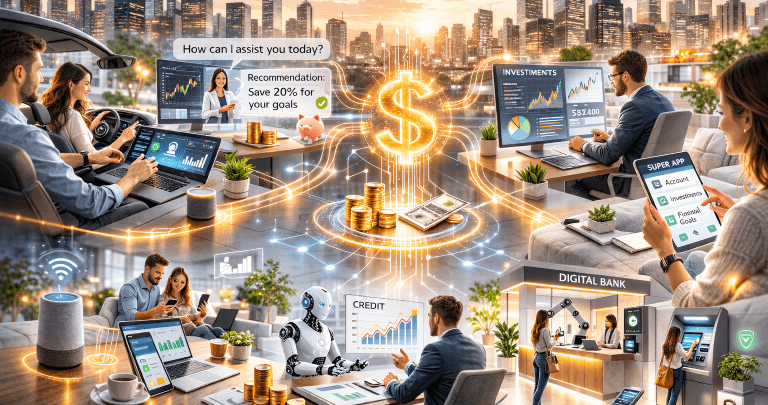

How Artificial Intelligence will redefine banks, investments, and the way people relate to money in the coming years

We are experiencing a revolution so profound that

its impact is already being compared to the Industrial Revolution, and it may even surpass that historic benchmark of transformation.

Artificial Intelligence (AI) is no longer merely a promising technology; it is reshaping the way we live, work, and think

in a transversal and permanent way. Whether in education, finance, healthcare, communication, or industry, AI has entered

the daily lives of people and organizations so naturally that, in a few years, we may not even call it “AI” anymore,

just as we do not say “electricity” every time we turn on a light. It simply becomes part of the world and of

human routine.

In finance, the impact tends to be even deeper.

That’s because the financial sector brings together a rare combination: massive volumes of data, highly automatable

processes, intense pressure for efficiency, and, at the same time, enormous investment capacity. In practice, we are talking

about one of the sectors with the greatest potential for transformation in the world.

Finance is about to change for good

The financial sector has always been one of the

first to adopt technology. Just think of how banks pioneered ATMs, internet banking, and mobile apps. More recently, digital

banks and fintechs have accelerated this movement, reducing bureaucracy and bringing services into the palm of the hand.

AI is arriving as the next major wave. And it is

not here simply to “improve” what already exists. It is here to change the rules of the game. From now on, it’s

no longer about offering an app with banking features. It’s about creating an intelligent ecosystem capable of understanding

the customer, anticipating needs, reducing risks, and delivering experiences that feel natural. This is where the concept

of the intelligent Super App begins to gain strength.

The intelligent Super App: the bank stops being

a place and becomes a presence

If today it is already possible to do practically

everything through an app, the trend is for banks to evolve toward an even more complete model. An intelligent Super App will

be much more than a transaction channel; it will be a continuous interface for relating to money. The customer will not just

open the app to pay bills or make transfers. They will use the bank as a “control center” for their financial

life. And, with AI, that control center stops being reactive and becomes proactive.

This means the app doesn’t just respond. It

suggests, alerts, guides, and even educates. And most importantly: it does so based on the customer’s real history,

spending habits, risk profile, life goals, and the opportunities that best fit that moment.

Conversational interfaces: people will talk to

banks

One of the most visible advances in the coming years

will be the gradual replacement of menus, screens, and buttons with conversational interfaces. Instead of navigating through

several options, the user will simply say something like: “I want to organize my monthly budget”; “How much

can I invest without compromising my bills?”; “Show me my delivery spending over the last 90 days”; “What’s

the best way to save money to travel at the end of the year?”.

This change may seem simple, but it is profound

because it shifts user behavior and, most importantly, redefines what “service” means. The bank stops being a

system with features and becomes a real financial assistant. And that assistant will not exist only inside the app. It will

be everywhere. In the car, on the TV, on devices like Alexa, on wearables, on voice interfaces, on kiosks, on digital channels,

and even on corporate platforms. The bank becomes an intelligent layer integrated into everyday life.

The bank of the future won’t just process

transactions. It will educate

Perhaps one of the greatest opportunities (and one

of the greatest competitive advantages) lies here: AI will transform banks into financial educators. And this is especially

relevant because, for most people, finance is still a confusing, distant, or even stressful subject. Many customers want to

invest, control their spending, or plan for the future, but they don’t know where to start. AI can fill that gap.

Based on the customer’s history, the bank

will be able to suggest small changes that make a difference, such as warning about recurring expenses that have grown without

them noticing, recommending adjustments to avoid interest, indicating better timelines for purchases, suggesting investments

consistent with the customer’s profile, and guiding goals with clarity. This creates a completely different relationship

between institution and customer. The bank stops being seen only as a “place that charges you” and becomes a financial

partner. And when that happens, loyalty reaches a new level.

Reports, analysis, and real-time decisions: AI

as the invisible engine

While the customer lives a simpler and more human

experience, behind the scenes AI will be doing the heavy lifting. The trend is that reports, analyses, and diagnostics that

once required time, teams, and long processes will be generated almost immediately. This applies to the end customer, but

it applies even more to the bank itself.

AI will be able to identify patterns, predict behavior,

detect risks, suggest actions, reduce losses, and support decisions at a pace that no traditional process can keep up with.

And this is not just about efficiency. It is about survival. In a competitive market, those who respond faster, understand

better, and make decisions more accurately gain an advantage.

More productivity, less dependence on physical

structure

The transformation brings an inevitable effect:

banks don’t need to be “big” in the sense of physical places. If service becomes more efficient, if operations

become automated, if the digital experience becomes completer and more intelligent, the need for branches decreases drastically.

This has been happening for years, but it will be amplified.

AI will allow institutions to do more with the same

number of people. And here there is an important point: this does not mean “replacing people”. It means freeing

people from repetitive work so they can focus on strategic, consultative, and high-value activities. In other words, AI does

not eliminate the human bank. It repositions the human role within the bank.

AI will enhance something that already exists

in finance

It’s important to understand that the financial

sector is not starting from scratch. Quite the opposite. Digital banks, open finance, automation, analytics, and mobile channels

have already created a solid foundation for this evolution.

AI does not create this movement. It enhances it.

It amplifies what already exists, accelerates trends, makes processes more intelligent, and makes experiences more fluid.

That is why, in finance, the impact tends to be faster and deeper than in many other sectors: because the infrastructure,

appetite, and context are already in place.

What changes for financial institutions and companies

in the sector?

For those inside the sector, the change is not only

technological. It is strategic. The question stops being “Are we going to use AI?” and becomes: “How will

we use AI to gain efficiency without losing governance?”; “How will we automate without compromising security

and compliance?”; “How will we evolve service without losing trust?”; “How will we turn data into

real value?”.

And here a crucial point comes in: AI applied to

finance requires maturity. It’s not enough to “add a chatbot.” It is necessary to design solutions that

integrate data, processes, security, user experience, and, above all, a clear business vision.

Visionnaire can help the financial sector accelerate

this transformation

Visionnaire has been developing custom software

and advanced technology solutions for 30 years. And in recent years, it has expanded this work with Artificial Intelligence

applied to real business challenges. For companies in the financial sector, this means building solutions that go beyond the

discourse and deliver what truly matters: robust, scalable, secure systems ready to operate in critical environments. Whether

to modernize platforms, create conversational experiences, automate processes, develop intelligent service solutions, or turn

data into decisions, AI is already a reality. And those who start now will be years ahead.

The future of finance will be intelligent, integrated,

and much more human in its experience. And it has already begun. Talk

to us and be part of the revolution.

This text is part of a special Visionnaire series

on the impact of AI across different sectors. Check out the other articles as well:

- AI

in Education: Trends for the Future

- AI in Healthcare: Trends for the Future

- AI in Telecommunications: Trends for the Future